Airline & Hotel

GST Input Tax Credit

Automation

Digitisation of Travel GST

ITC claim process drives significant benefits across

the

organization

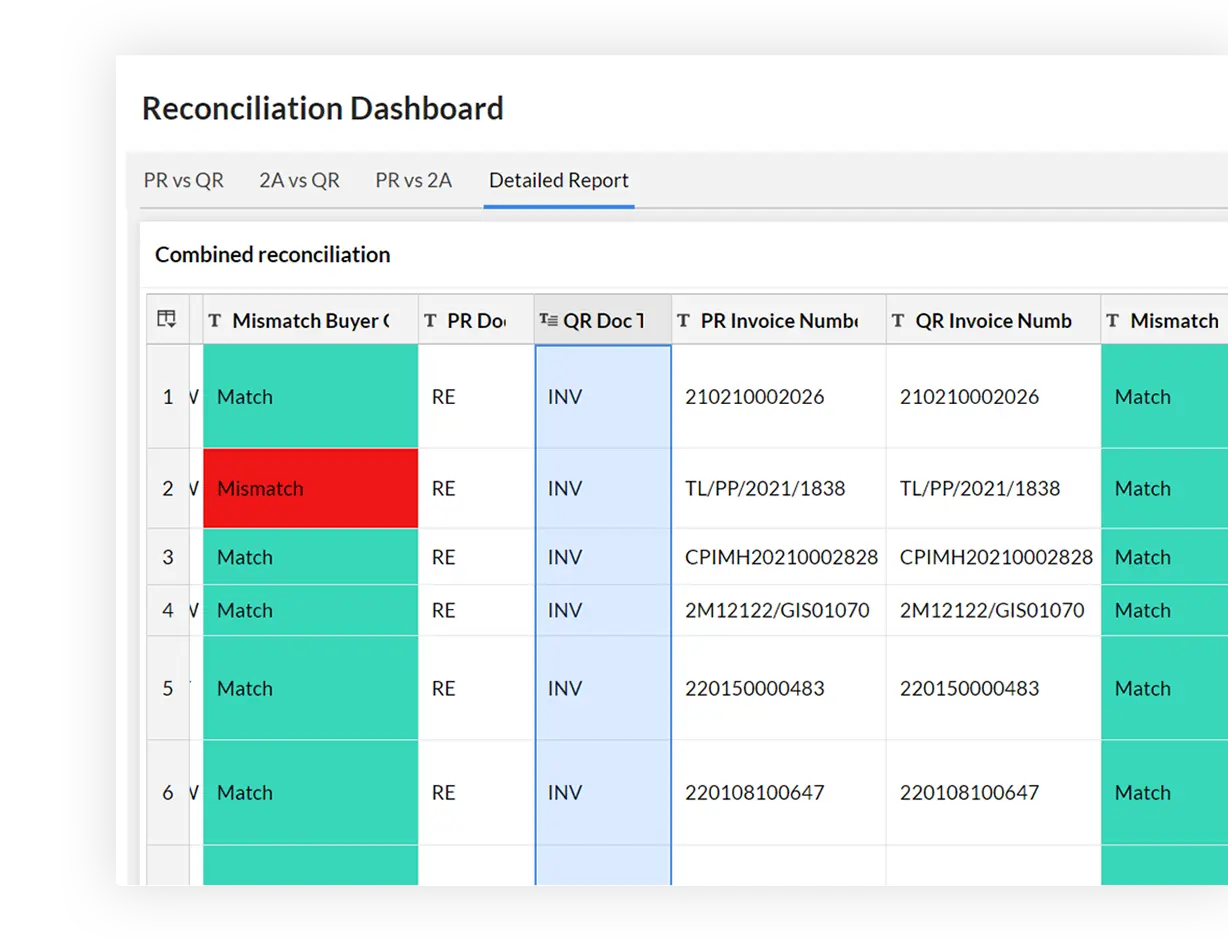

Finkraft Travel GST solution goes beyond the rudimentary task of invoice retrieval. The solution automagically reads every line from invoices issued by travel vendors (hotels & airlines), TMCs (travel agency), GST 2A/2B reports, BTA card reports and your ERP and reconciles the extracted data to find omissions, errors and missing invoices, errant invoices and errant filing by vendors. Consequently your organization complies with GST ITC claim processes with surgical precision and minimal human handling.

Industry-first,

6-way reconciliation ensures 100% eligible

GST ITC claim

Reconciling invoice data across data sets is complex and time consuming. Human errors in the recon process lead to significant and undetected losses and in the worst case lead to tax disputes and expensive litigation.

- Purchase register

- TMC invoice

- Airline invoice

- Credit card data

- GSTR 2A/2B

- Booking data/ ERP data